Table of Contents

Ever spotted the “VAT refund at the airport” sign during your travels and wondered what it’s all about? In this article, we’ll decode the process for you. Value Added Tax (VAT) refunds at the airport can put money back in your pocket when you shop abroad. We’ll guide you through the essentials, from eligibility to the steps involved, so you can make the most of this money-saving opportunity on your next trip.

What is a VAT Refund at the Airport?

Understanding Value Added Tax (VAT)

Value Added Tax, commonly known as VAT, is a consumption tax imposed by many countries on the purchase of goods and services. It’s a tax that’s added to the price of most products and services at every stage of production or distribution, and it’s ultimately paid by the end consumer.

The Concept of a VAT Refund at the Airport

When you travel to a foreign country whether for business or bleisure Travel, you often engage in shopping, buying souvenirs, clothing, or other items. These purchases may include VAT, which is included in the price you pay. However, as a tourist, you might be eligible for a VAT refund on certain goods you bought during your trip.

Here’s How it Works in Simple Terms

- Eligible Purchases: Not all purchases qualify for a VAT refund. Typically, it applies to goods that you’re taking out of the country and not using within that country, such as souvenirs or gifts.

- Retaining Receipts: To claim a VAT refund, you must keep your receipts. These receipts should show that you paid VAT on the items.

- Airport Refund Desk: Before you leave the country, visit the VAT refund desk at the airport. Present your eligible receipts and goods for inspection.

- Validation and Refund: Once your documents are validated, you may receive a refund either in cash, check, or credit to your card, depending on the country’s procedures.

- Leaving the Country: After receiving your refund, you can proceed with your departure.

The idea behind a VAT refund is to encourage tourism and provide a benefit to travelers. It allows you to recoup some of the taxes paid on eligible items, putting money back in your pocket. However, VAT refund rules can vary from country to country, so it’s essential to familiarize yourself with the specific regulations of the place you’re visiting.

VAT Refund Rules

When it comes to VAT refunds, understanding the rules and eligibility criteria is crucial for travelers seeking to recoup some of the taxes paid on their purchases. Here, we’ll delve into the basic rules and shed light on key considerations:

1. Eligible Purchases

- VAT refunds typically apply to goods that you’re taking out of the country and not using within that country.

- Common eligible items include clothing, electronics, souvenirs, and other tangible goods.

- Services, consumables, and certain high-value items may not be eligible.

2. Minimum Purchase Amount

- Many countries impose a minimum purchase threshold for VAT refunds. You must spend a certain amount on eligible items to qualify.

- The minimum purchase amount can vary, so check the specific requirements of the country you’re visiting.

3. Time Limit

- There’s usually a time limit for claiming VAT refunds. You’ll need to apply for the refund within a specified timeframe from the date of purchase.

- This period can vary but is often several months.

4. Proof of Purchase

- Travelers must retain their original receipts, which should clearly show that VAT was paid on the items.

- Ensure that the retailer provides a proper VAT invoice.

5. Departure from the Country

- VAT refunds are typically processed at the airport when you’re leaving the country. You’ll need to show both the purchased goods and the associated receipts at the VAT refund desk.

- Customs authorities may inspect the items to verify that they’re leaving the country with you.

6. Specific Limitations

- Some countries have specific rules and limitations. For instance, certain items like jewelry or luxury goods might have different refund rates or requirements.

- Look out for special procedures or restrictions related to duty-free shopping zones within the airport.

7. Refund Methods

- The refund can be provided in different forms, including cash, check, or a credit to your credit card.

- Be prepared for administrative fees that may be deducted from your refund.

8. Keep Documentation

- It’s essential to keep all relevant documents, such as the refund forms provided by the retailer and any customs stamps, as these may be required to complete the refund process.

How to Get Your Refund?

Claiming a VAT refund at the airport or another designated point is relatively straightforward. Here’s a step-by-step guide to help travelers navigate the process:

- Shop Wisely: Make eligible purchases during your trip, ensuring they meet the minimum spending requirements for VAT refunds.

- Keep Your Receipts: Retain original receipts that clearly indicate VAT paid on the items. The retailer should provide a proper VAT invoice.

- Request a VAT Refund Form: Ask the retailer for a VAT refund form or tax-free shopping form. Complete the form with accurate details, including your contact information.

- Visit Customs: Before checking in for your departure flight, go to the customs desk or designated tax refund point within the airport. Be sure to have your purchased items, receipts, and passport on hand.

- Inspection: Customs authorities may inspect your items to verify that they are indeed leaving the country with you.

- Stamp of Approval: Present your completed VAT refund form, along with your receipts and purchased goods, to customs. They will inspect and stamp the form, confirming your eligibility for a refund.

- Refund Desk: Head to the VAT refund desk, usually located in the departure area, after clearing customs. Submit your stamped VAT refund form.

- Choose Your Refund Method: Select your preferred refund method, which can be in cash, by check, or credited back to your credit card. Some airports may have multiple refund counters for different methods.

- Processing Fees: Be aware that some administrative fees may be deducted from your refund amount.

- Keep Documents Safe: Safeguard all relevant documentation, including the refund form and customs stamps, as they may be required for future reference.

For a successful business trip, making the most of VAT refunds can help offset expenses and make your journey more cost-effective.

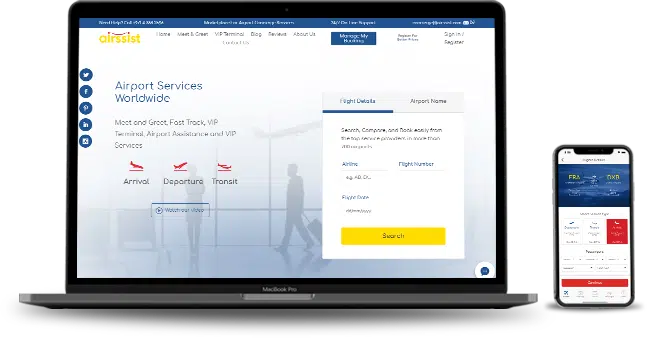

Simplifying the Process with airssist

We are your trusted partner in streamlining the VAT refund process for travelers, offering personalized assistance that ensures convenience and efficiency. With airssist’s expert guidance, travelers can navigate the complexities of VAT refund regulations with ease. We not only save valuable time but also offer multiple refund options, making it a stress-free experience, particularly beneficial for busy business travelers. Our seasoned team provides valuable insights, allowing you to maximize your refund potential and focus on your stress-free business travel goals.

Unlock Travel Savings

Unlocking travel savings, particularly through VAT refund airport opportunities, is a savvy way for travelers to make the most of their international journeys. By grasping the ins and outs of Value Added Tax (VAT) refunds and the assistance available, travelers can transform routine shopping into a strategic means of stretching their travel budget.

FAQs on VAT Refund at Airport

1. Who is Eligible for a VAT Refund?

Tourists visiting a foreign country can often claim VAT refunds on eligible purchases they're taking out of the country.

2. Is There a Minimum Purchase Amount for VAT Refunds?

Yes, many countries have a minimum spending requirement. Check the specific amount for your destination.

3. How Long do I Have to Claim a Refund?

The timeframe varies, but you typically need to apply within a few months of the purchase.

4. What's the Refund Processing Time?

Processing times can vary, but refunds are often issued at the airport when you depart.

5. Are There Administrative Fees for Refunds?

Some refund providers deduct administrative fees from your refund amount.

6. Can I Claim VAT Refunds for Business Expenses?

Business travelers may be eligible for VAT refunds on certain business-related expenses. Check with local regulations.

7. Are All Items Eligible for a Refund?

No, only certain goods qualify. Common eligible items include clothing, electronics, and souvenirs.

Note: Please note that the information on this page is generic & subject to change due to fluctuations in airport services. Kindly confirm service availability with our team, as offerings may vary daily.

French | Français

French | Français Spanish | Espana

Spanish | Espana German | Deutch

German | Deutch Arabic | العربية

Arabic | العربية Chinese | 中文(简体)

Chinese | 中文(简体)  Japanese | 日本語

Japanese | 日本語